Bitcoin has gone up to more than $46,000, and like I said before, I think it’s going to hit $50,000 really soon. I have a strong feeling about this. Bitcoin’s been growing super fast, so it’s important to talk about where it might go next. We should also check out some other cryptocurrencies that seem promising.

Bitcoin’s Price Momentum Signals Upward Trend

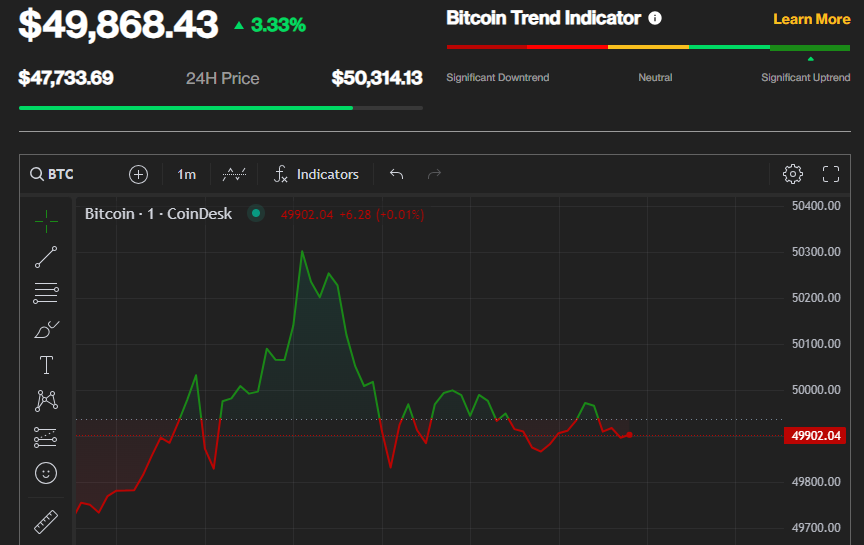

Bitcoin went up past $46,000, keeping a steady climb. It was below $45,000 earlier but quickly went above that. This good trend makes it seem like we might hit $49,000, like we did a few weeks ago. Right now, Bitcoin’s progress seems like nothing can stop it.

The whole market is growing too, with a total value of $1.73 trillion, but Bitcoin is leading the way. It’s going up because more people want it, and there’s not enough to go around. Yesterday, the volume of ETFs also shows that Bitcoin’s going up.

Bitcoin Price Correlated with ETF Accumulation

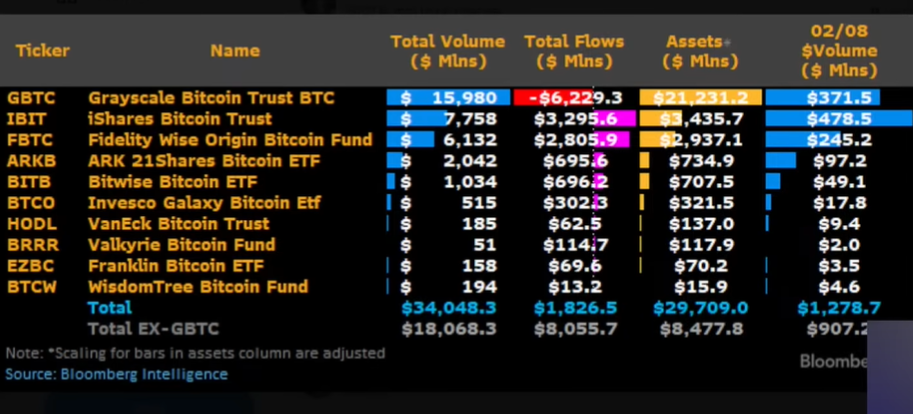

ETF volumes are high today and expected to be even higher tomorrow. Black Rock has surpassed Gray scale in volume, holding over $3.4 billion. Fidelity is close behind with nearly $3 billion.

Arkham and Bitwise have volumes above $700 million. In just two and a half weeks, $18 billion worth of Bitcoin has flowed into these funds, effectively reducing its circulation.

This trend is expected to continue, with tomorrow’s volume projected to be higher. The fear of missing out (FOMO) will impact both retail investors and institutions.

The correlation between Bitcoin flowing into ETFs and price increase is evident, as demand exceeds supply. Only 5.3% of Bitcoin is currently on exchanges, indicating limited supply for trading.

Bitcoin OTC Market: Limited Supply Causes Price Increases

Since December of 2017, there has been a noticeable decrease in the Bitcoin supply. Despite some complaints from individuals, large buyers continue to purchase through over-the-counter (OTC) markets.

However, it is important to understand that the OTC market is not infinite like the Federal Reserve. Bitcoin cannot be printed and sold to these big players at will. When there is a shortage, they have to acquire it from other sources such as the spot market or directly from miners.

Nevertheless, the supply is limited, and there is only a finite amount of Bitcoin being produced each day. Additionally, it is worth noting that the upcoming halving event in approximately two months will further reduce the daily production.

Ultimately, the price of Bitcoin is determined by the basic principles of supply and demand. Currently, we are witnessing a breakout in the short term.

Bitcoin Chart Shakeouts

We’ve seen shakeouts, like the drop to 38,000, after reaching 49,000 due to ETF hype. But previous bull runs had drops too, and they didn’t end after one or two drops.

So, this is normal. Volatility is lower now. Hold onto your investments for potential wealth. Keep dollar-cost averaging before big players accumulate Bitcoin. We’re at 46,600 now.

Let’s discuss other crypto projects led by Bitcoin. Altcoins are catching up, except for Ethereum. Solana, BNB, and Cardano stand out. Stacks surged with Tim Draper’s involvement.

Stacks and Bitcoin: A Strong Competitor in Decentralized Applications

Stacks, a leading Bitcoin advocate, praises the platform for its role in developing programmable decentralized applications (dapps) on Bitcoin. This unique capability has generated interest in using Stacks for creating new dapps and decentralized finance (DeFi) products on the Bitcoin network.

Stacks is gaining popularity and is set to become even more impressive with an upcoming upgrade. This upgrade aims to improve efficiency, speed, and security, positioning Stacks as a strong competitor to platforms like Cardano and Ethereum.

While Stacks is still growing in terms of total value locked (TVL) and liquidity, it has the potential to become a powerhouse in the industry, comparable to Ethereum and Solana. Therefore, it is important to monitor Stacks closely as it aligns with Bitcoin’s success.

Shifting focus to Polygon, the platform has formed a significant partnership, demonstrating its commitment to expanding its influence and capabilities in the blockchain space.

Polygon’s Continuous Growth and Attraction of Global Brands

Polygon is undergoing upgrades and attracting a wide range of brands. They recently partnered with Fox for content and image verification, adding to their impressive list of partners like DraftKings, NFL, Starbucks, and Nike.

This has contributed to their significant growth, with almost as many users added in 2023 as Ethereum. They have also established important partnerships, particularly with their ZK EVM implementation, which is crucial for their future. Immutable is one of the chains that will be using it.

Immutable: The Launch of Sphere NFT Marketplace

Beam has partnered with Immutable to introduce a new NFT-focused Marketplace called Sphere in the gaming industry. They have already started onboarding projects, including Immutable and Ubisoft.

Van Ike, a Bitcoin ETF provider, has listed Immutable as a top prediction for 2024, highlighting the potential of gaming. The collaboration between Beam, Immutable, Polygon, and other projects like Stacks showcases the strength of this network.