Sukanya Samriddhi Yojana has increased its interest rate from 8% to a new rate of 8.2%. The central government announced this news ahead of the Lok Sabha elections in 2024.

The central government, led by Prime Minister Narendra Modi, launched the Sukanya Samriddhi Yojana on January 22, 2015, under the Beti Bachao and Beti Padhao campaigns. Between 2018 and 2021, 1.43 crore Sukanya Samriddhi Yojana accounts were opened. This is a government-backed savings scheme provided to secure the future of the daughter.

What is Sukanya Samriddhi Yojana Scheme?

Sukanya Samriddhi Yojana (SSY) Scheme:

- The SSY scheme provides funds for a girl child’s education as well as their marriage expenses.

- Allows guardians or parents to invest regularly, such as on a monthly basis.

- The invested amount can be withdrawn with interest upon maturity.

- The scheme is both risk-free and tax-free.

- The invested amount can be withdrawn at maturity, which is 21 years from the account opening date.

- For example, if the account is opened at the age of 6, eligibility for withdrawal is at 26 years of age for the child.

- Some exceptions allow withdrawal before maturity.

Interest and Tax Benefits:

- Investors do not pay any tax on the amount invested.

- The SSY scheme offers more interest compared to Fixed Deposits (FDs) or other government schemes.

- From 2021, the interest rate remained unchanged at 7.6% per annum.

- However, in April 2023, the interest rate increased to 8% per annum.

- The government reviews and changes the interest rates quarterly.

What are the Eligibility Criteria for the Sukanya Samriddhi Yojana scheme?

Age Eligibility:

- The girl child must be under 10 years of age for account opening.

Number of Accounts:

- Each girl child is eligible for only one account.

- In one family, a maximum of two accounts can be opened, each for a different girl child.

- An exception is made for families with twin daughters, allowing them to open three accounts.

Adopted Girl Child:

- Families with legal documents for an adopted girl child are also eligible to open an account under the SSY scheme.

What are the Features and Benefits of SSY Scheme?

Investment Limits:

- Minimum investment: 250 rupees.

- Maximum investment: Up to 1.5 lakhs rupees per annum.

Annual Investment Process:

- After SSY account opening, 250 rupees should be invested annually for 15 years.

- The investment continues and earns interest until maturity.

Maturity Period:

- The time period for the SSY scheme is 21 years.

- Withdrawals are not allowed until 21 years from the account opening.

- Some exceptions allow premature withdrawals in specific cases.

Exceptions for Withdrawals:

- Eligibility for withdrawal: For example, when the girl reaches 18 years or completes 10th grade.

- Withdrawal limit: Up to 50% of the balance from the previous financial year for higher education purposes.

Premature Closure:

- The account can be closed prematurely if the girl turns 18 years old for her marriage.

Sovereign Guarantee:

- The SSY scheme provides a sovereign guarantee.

- In the event of the post office or bank closure after account opening, the invested amount remains safe.

How to Calculate Returns on Sukanya Samriddhi Yojana?

The image shows that the account opening age of the girl child is 6 years, with a yearly investment of 10,000 rupees. After 21 years, if there are no premature withdrawals, the amount will be around 4,48,969 rupees. The total investment would be 1,50,000 rupees, with total interest around 2,98,969 rupees.

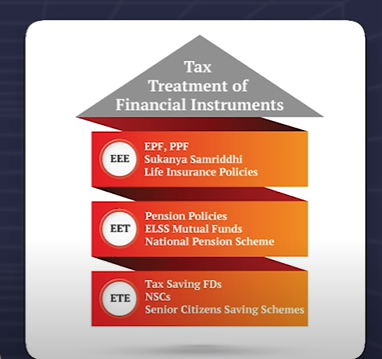

SSY offers a good interest rate compared to other schemes and banks, and it also provides tax-free interest. SSY is the kind of scheme that operates on the principles of EEE, EET, and ETE, as mentioned in the image depicting the tax treatment of financial instruments. For a detailed explanation and better understanding, please watch the video.

How to Open Sukanya Samriddhi Yojana (SSY) Account?

Account Opening Process:

- To open a Sukanya Samriddhi Yojana (SSY) account, visit a post office, government-designated bank, or some private banks.

- Currently, there is no online portal for Sukanya Samriddhi Yojana.

Form Submission:

- Fill out the SSA-1 form. You can fill the form at the nearest post office, through the Reserve Bank of India (RBI), India Post Office, or participating bank websites.

Required Documents:

- Submit the form along with the girl’s birth certificate and proof of identity for parents or guardians (e.g., Aadhar card, PAN card) and address proof (e.g., electricity bill).

Deposit Process:

- After submitting the documents and form, deposit some amount. Payment can be made through a cheque, demand draft, or online.

Approval and Passbook Issuance:

- The post office or bank will approve the application for account opening.

- Once approved, they will provide the Sukanya Samriddhi Yojana passbook.

Transferability:

- The SSY account can be transferred from one post office or bank to another, especially in the case of a city transfer or for other reasons.